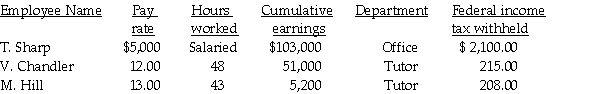

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total deductions.

Definitions:

Immune Response

The body's defensive reaction to foreign substances or organisms, involving recognition and destruction.

Tumor-suppressor Genes

Genes that protect a cell from one step on the path to cancer; when these genes are mutated or inactivated, the risk of cancer development increases.

Defective Alleles

Variants of genes that do not function correctly, often leading to disorders or reduced fitness in organisms.

Q2: From the following information, prepare the bank

Q2: Which of the following accounts will be

Q19: Which of the following columns of the

Q45: An employee assigned the responsibility for overseeing

Q67: The CFC College Credit Card Services has

Q79: Marie's Law Firm's unadjusted trial balance includes

Q100: Prepare the necessary general journal entry for

Q118: On the basis of the following data

Q125: When a bank credits your account, it

Q126: Prepaid Workers' Compensation Insurance is what type