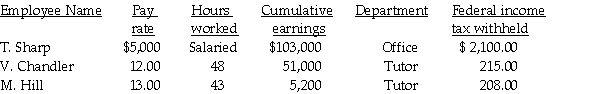

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total gross earnings for the tutors.

Definitions:

Aphasia

A neurological disorder characterized by the loss or impairment of the ability to produce and/or comprehend language, usually due to brain damage.

Task Oriented

Refers to being focused primarily on completing specific goals or tasks rather than on the broader context or relationships involved.

Professional Behavior

Conduct or actions deemed acceptable and appropriate within a professional setting, often based on ethical standards and practices.

Speech Therapist

A healthcare professional specialized in assessing, diagnosing, and treating speech, language, communication, and swallowing disorders.

Q23: Jefferson Tutoring had the following payroll information

Q33: Compute the total deductions for the employees'

Q47: At the start of this year 18

Q57: Bob purchased a truck for $53,000 with

Q70: A Schedule of Accounts Payable is a

Q74: Generally, employers can take a credit against

Q85: Not all adjusting entries can be reversed.

Q87: Use the following information to answer the

Q111: The entry to close the expense account(s)

Q123: When the adjustment is made for depreciation,