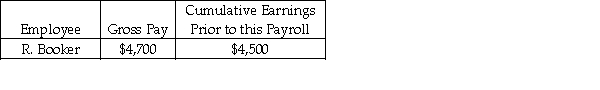

Jefferson Tutoring had the following payroll information on February 28:  Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Using the information above, the journal entry to record the payroll tax expense for Jefferson Tutoring would include:

Definitions:

Confidence Interval

A selection of numerical values, culled from sample data, likely to hold within it the value of an unrevealed population parameter.

Population Mean

The average of all the data points in a population, representing the central tendency of the entire population's values.

Sample Mean

The average value of a set of data points taken from a sample of a larger population.

Population Parameter

A numerical value that represents a characteristic or feature of an entire population.

Q31: What type of an account is Wages

Q35: The entry to close the Withdrawals account

Q62: FICA taxes provide funding to the government

Q64: John's Tree Service depreciation for the month

Q75: Calculate gross sales:<br>net sales = $100,000<br>sales returns

Q75: Which of the following would NOT typically

Q78: The adjusted trial balance on the worksheet:<br>A)

Q107: _ Replenishment of petty cash<br>A)New check written<br>B)

Q110: Grammy's Bakery had the following information for

Q124: The beginning capital balance is $1,600; there