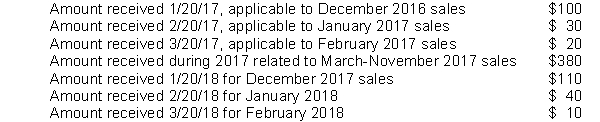

A city levies a 2 percent sales tax that is collected for them by the state. Sales taxes must be remitted by the merchants to the state by the twentieth day of the month following the month in which the sale occurred. The state has a policy of remitting sales taxes to the city within 30 days of collection by the state. Cash received by the state related to sales taxes is as follows:  Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/17?

Assuming the city uses the same period to define "available" as the maximum period allowable for property taxes, what amount should it recognize as sales tax revenue in its government-wide financial statements for the fiscal year ended 12/31/17?

Definitions:

Whistle-Blowing

The act of exposing any kind of information or activity that is deemed illegal, unethical, or not correct within an organization.

Liability Law

The area of law that deals with legal responsibilities and obligations.

Danger Symbols

Visual signs or icons used to warn people of potential hazards or dangerous conditions.

Fair-Use Concept

A legal principle that permits limited use of copyrighted material without permission for purposes like criticism, commentary, or education.

Q1: Which of the following is NOT a

Q10: The amount of sick leave expense that

Q21: At what value should the new truck

Q39: Why is long-term debt generally not reported

Q42: Benchmarking often compares a company against a

Q53: GAO standards specify that performance audit reports

Q66: In which of the following circumstances must

Q67: As used in defining the modified accrual

Q71: At the beginning of its fiscal year,

Q150: Management's discussion and analysis of financial condition