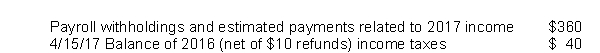

During 2017, a state has the following cash collections related to state income taxes  1/15/18 payroll withholdings and estimated payments related to 2017 income $ 30

1/15/18 payroll withholdings and estimated payments related to 2017 income $ 30

2/15/18 payroll withholdings and estimated payments related to 2017 income $ 35

3/15/18 payroll withholdings and estimated payments related to 2017 income $ 25

4/15/18 Balance of 2017 (net of $5 refunds) income taxes $ 45

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 government-wide financial statements related to state income taxes?

Definitions:

Withholding Allowance

A deduction that employees can claim to reduce the amount of their income that is subject to federal income tax withholding.

Gross Earnings

The total amount of income earned by an individual or a business before any deductions like taxes, benefits, and other adjustments.

Withholding Allowance

A determination made by employees on their W-4 form that influences the amount of federal income tax withheld from their paycheck.

Federal Income Tax

A yearly fee assessed by the national government on the income of individuals, corporations, trusts, and assorted legal entities.

Q2: What are the possible differences that may

Q17: GAAP require state and local governments to

Q23: The following list of cash flows was

Q27: State Community College, a public college, grants

Q28: Which of the following is NOT a

Q47: If an entity elects to focus on

Q48: Under GAAP, property taxes levied in one

Q64: Jona City has designated an internal service

Q83: The financial statements for Watertown Service Company

Q100: In a vertical analysis of the balance