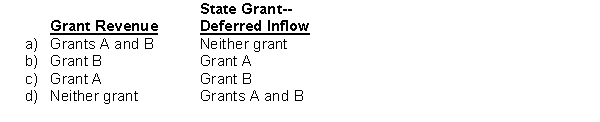

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2016. Grant A can be used to cover any operating expenses incurred during fiscal 2017. Grant B can be used at any time to acquire equipment for the city's fire department. Should the city report these grants as grant revenues or deferred inflows in its governmental fund financial statements for fiscal 2016?

Definitions:

Accrued Interest

Interest that has been incurred but not yet paid, often related to bonds or loans.

Bond Issue Costs

The expenses associated with the issuance of bonds, including legal, accounting, underwriting fees, and other related costs.

Straight-Line Method

A method of calculating depreciation by evenly allocating the cost of an asset over its useful life.

Effective Interest Method

A technique used in accounting to allocate the interest expense or income of a financial instrument over its lifespan in a way that results in a constant rate on the carrying amount.

Q37: Assume that the City of Pasco maintains

Q38: A government's unassigned general fund balance at

Q42: The statement of cash flows explains why

Q45: Linden County operates a solid waste landfill

Q46: A city levies a 2 percent sales

Q54: Per GASB, governments should report resources and

Q57: Scarlett City's general fund activities for 2019

Q91: There are three main ways to analyze

Q99: The trend analysis report of Marshall, Inc.

Q133: The vertical analysis statement of Bateman, Inc.