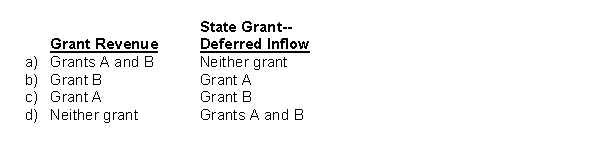

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2016. Grant A can be used to cover any operating expenses incurred during fiscal 2017. Grant B can be used at any time to acquire equipment for the city's fire department. Should the city report these grants as grant revenues or deferred inflows in its government-wide financial statements for fiscal 2016?

Definitions:

Tombstones

Advertisements in financial publications summarizing the terms of a new issue of securities.

Public Offering

The process of selling stocks or bonds to the public for the first time, also known as an initial public offering (IPO) for stocks.

Dilution %age Ownership

The reduction in existing shareholders' ownership percentage of a company as a result of the company issuing more shares.

Q4: Property taxes levied on the citizens of

Q28: Users of government financial statements should be

Q34: How should governments report their capital projects

Q38: What is the primary reason that governmental

Q43: Under which set of auditing standards is

Q44: The GAO publication Government Auditing Standards (commonly

Q46: Dumas County has a December 31 fiscal

Q52: In the government-wide financial statements, the assets

Q54: Per GASB Statement No. 34, permanent funds

Q56: Donald Corp. reported the following on its