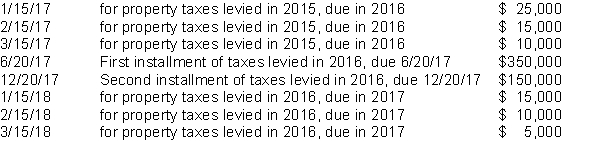

A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP. Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2016 to finance the activities of fiscal year 2017. Property taxes are due in two installments June 20 and December 20. Cash collections related to property taxes are as follows:  The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2017 is:

The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2017 is:

Definitions:

Catastrophes

Extreme and sudden disasters or events causing significant damage or suffering.

Hassles

Hassles are minor irritations or annoyances that individuals encounter in everyday life, which can accumulate and contribute to overall stress.

Eustress

Positive stress that has beneficial effects on health, motivation, performance, and emotional well-being.

Death Rate

The statistical measure of the number of deaths per unit of population, typically expressed per 1,000 or 100,000 people per year.

Q4: List the three ways to analyze financial

Q15: When a fax machine purchased by a

Q18: State University, a very large public university,

Q21: Fiduciary activities are where governments act as

Q22: With regard to accounting for infrastructure, which

Q39: Merchandise inventory and prepaid expenses are excluded

Q46: Which of the following statements is not

Q117: The three sections of the statement of

Q162: Data for Kalil, Inc. follows: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7388/.jpg"

Q166: e-Shop, Inc. has net sales on account