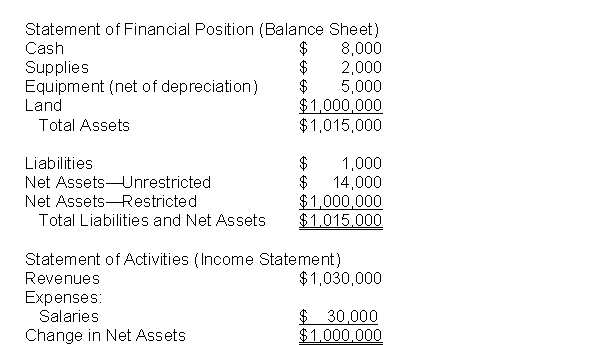

Save-the-Birds (STB), a not-for-profit entity dedicated to acquiring and preserving habitat for upland birds, prepares financial statements in accordance with generally accepted accounting principles. Currently, standards require that a not-for-profit entity report virtually all contributions as revenue in the year received. During the current year STB received a donation of several hundred acres of prime habitat for upland birds. STB will require several hundred thousand dollars in additional donations in order to make the land completely suitable for the birds. Before embarking on its fund-raising campaign STB prepares financial statements which are summarized as follows.  What difficulties, if any, will STB encounter in its new fund-raising drive? Knowing that the donation of the land accounted for $1,000,000 of the revenue reported by STB, do you think the financial statements present fairly the financial position and results of operations of this not-for-profit entity?

What difficulties, if any, will STB encounter in its new fund-raising drive? Knowing that the donation of the land accounted for $1,000,000 of the revenue reported by STB, do you think the financial statements present fairly the financial position and results of operations of this not-for-profit entity?

Definitions:

Specialized Electric Motors

Electric motors that are designed and manufactured for specific applications or to meet particular requirements, distinguishing them from standard or generic motors.

Cost Drivers

Factors that cause changes in the cost of an activity or operation, influencing the total expenses.

Manufacturing Overheads

Expenses related to the manufacturing process that are not directly tied to the production of individual units, such as factory rent and machinery maintenance.

Activity-based System

An accounting method that assigns costs to products or services based on the activities that go into producing them, aiming for more accurate costing by tracing resources consumed by activities.

Q5: Financial statements, no matter how prepared, do

Q18: State University, a very large public university,

Q48: On the maturity date of a bond

Q49: What is "deferred maintenance?" What is its

Q50: The Breast Cancer Fund, a not-for-profit organization,

Q67: A horizontal analysis would be used if

Q73: A security is a share or interest

Q144: O'Brien Coatings Company uses the indirect method

Q150: Clark Coatings Company uses the indirect method

Q154: The operating activities section of the statement