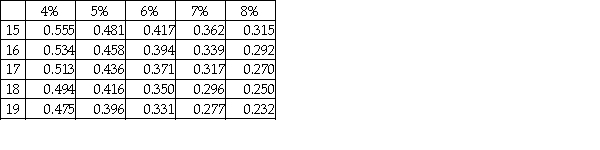

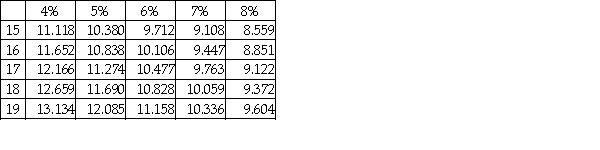

The face value is $81,000, the stated rate is 10%, and the term of the bond is eight years. The bond pays interest semiannually. At the time of issue, the market rate is 8%. What is the present value of the bond at the market rate? Present value of $1:  Present value of annuity of $1:

Present value of annuity of $1:

Definitions:

Indirect Approach

A communication strategy that involves conveying a message in a less straightforward manner, often to ease into sensitive topics or facilitate smoother interactions.

Longer Speeches

Extended oral presentations aimed at informing, persuading, or entertaining an audience.

Indirect Approach

A communication strategy where the main point is not presented directly at the beginning but is gradually introduced through explanation or evidence.

Resistant

Refers to the ability to withstand or oppose a particular force or effect.

Q11: Which of the following is true of

Q16: Rosewood, Inc. recently signed a $356,000, six-month

Q35: When using the effective-interest amortization method, the

Q37: List the two categories of liabilities reported

Q103: Employer FICA is paid by the employer

Q130: Lewis, Inc. uses the indirect method to

Q138: Which of the following statements is true

Q140: Financing activities on the statement of cash

Q154: When a bond is issued at a

Q171: The current portion of long-term notes payable