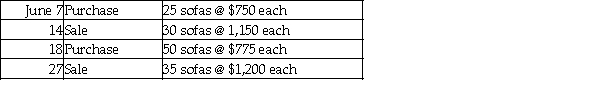

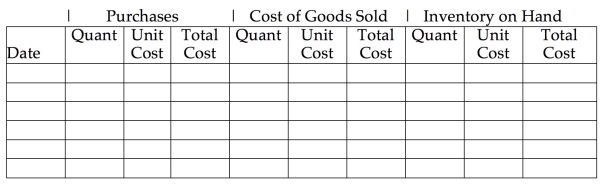

McClain Designs Furniture began June with merchandise inventory of 45 sofas that cost a total of $31,500. During the month, McClain Designs purchased and sold merchandise on account as follows:  Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.)

Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.)

Definitions:

Plant Assets

Long-term tangible assets used in the production of goods and services, such as buildings, machinery, and equipment.

Cash Flows

The net amount of cash and cash equivalents being transferred into and out of a business.

Operating Activities

Activities that relate to the primary operations of the company, including cash flows from selling goods and services.

Indirect Method

A way of presenting the cash flow statement where net income is adjusted for changes in balance sheet items to calculate cash flow from operating activities.

Q21: A company is uncertain whether a complex

Q24: Burglar alarms, fire alarms, and security cameras

Q27: On October 1, 2017, Parkin, Inc. made

Q27: Portian Merchandisers has purchased merchandise on account

Q38: Cobbe Sales sold 400 units of product

Q94: The Supplies Expense account is a temporary

Q103: The main computer where data is stored,

Q128: A point-of-sale terminal provides control over cash

Q160: The Depreciation Expense account is a temporary

Q192: _ are the expenses that occur in