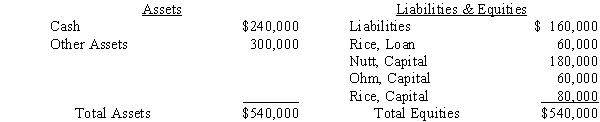

The NOR Partnership is being liquidated. A balance sheet prepared prior to liquidation is presented below:  Nutt, Ohm, and Rice share profits and losses in a 40:40:20 ratio. All partners are personally insolvent.

Nutt, Ohm, and Rice share profits and losses in a 40:40:20 ratio. All partners are personally insolvent.

Required:

A. Prepare the journal entries necessary to record the distribution of the available cash.

B. Prepare the journal entries necessary to record the completion of the liquidation process, assuming the other assets are sold for $120,000.

Definitions:

Business Invitees

Individuals who enter a property for a purpose directly connected with the business interests of the property owner.

Duty To Exercise

The obligation to perform or engage in actions with due diligence and care under certain circumstances.

Rightful Possession

The legal right of an individual or entity to use, control, or occupy property or assets under the law.

Good Samaritan Statutes

Laws designed to provide legal protection to individuals who voluntarily provide aid or assistance to others in distress without expecting compensation.

Q4: Gains and losses that arise in an

Q10: Under the Uniform Partnership Act:<br>A) partnership creditors

Q20: Pruin Corporation acquired all of the voting

Q24: On January 1, 2016, Prima Company issued

Q26: The parent company records the receipt of

Q27: Patriot Corporation owns 100% of Simon Company's

Q32: Garlic, Pepper, and Salt are partners in

Q37: Board designated funds should be accounted for

Q65: The Salaries Payable account is a(n) _.<br>A)

Q194: What is the calculation for return on