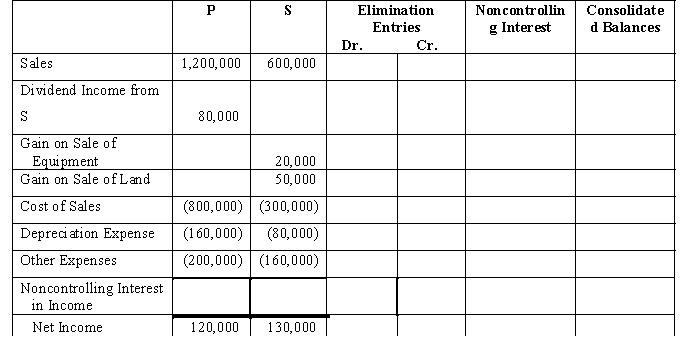

P Corporation acquired 80% of the outstanding voting stock of S Corporation when the fair values equaled the book values.

On July 1, 2016, P sold land to S for $300,000. The land originally cost P $200,000. S recently resold the land on October 30, 2017 for $350,000.

On October 1, 2017, S Corporation sold equipment to P Corporation for $80,000. S originally paid $100,000 for this equipment and had accumulated depreciation of $40,000 thus far. The equipment has a five-year remaining life.

Required:

A. Complete the consolidated income statement for P Corporation and subsidiary for the year ended December 31, 2017.

Definitions:

Adrenal Enlargement

An increase in the size of the adrenal glands, which can be due to various conditions and may affect hormone production and release.

Thymus

A small organ in the immune system where T lymphocytes mature and differentiate.

Lymph Node

A small, bean-shaped structure that is part of the lymphatic system and works as a filter for harmful substances.

Stomach Ulceration

The development of ulcers in the stomach lining, often caused by infection, excessive acid production, or prolonged use of certain medications.

Q4: Parr Company owned 24,000 of the 30,000

Q10: Sleepy Company, a 70%-owned subsidiary of Pickle

Q11: If annual major repairs made in the

Q12: On January 1, 2016, Pent Company and

Q25: If Monica and Chandler decide to specialize

Q25: If the fair value of the subsidiary's

Q34: On November 30, 2016, Piani Incorporated purchased

Q39: Which of the following does NOT have

Q51: List and briefly explain each of the

Q167: As we move from one efficient point