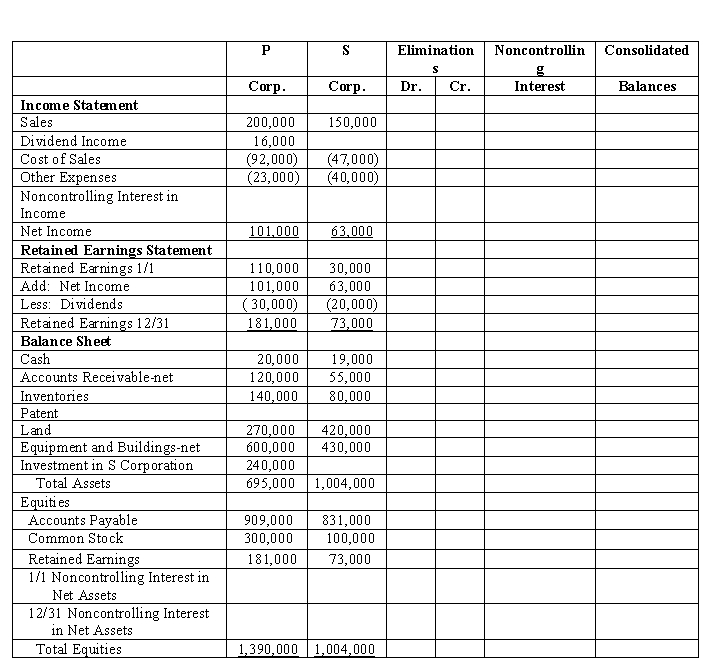

P Corporation acquired 80% of S Corporation on January 1, 2017 for $240,000 cash when S's stockholders' equity consisted of $100,000 of Common Stock and $30,000 of Retained Earnings. The difference between the price paid by P and the underlying equity acquired in S was allocated solely to a patent amortized over 10 years.

P sold merchandise to S during the year in the amount of $30,000. $10,000 worth of inventory is still on hand at the end of the year with an unrealized profit of $4,000. The separate company statements for P and S appear in the first two columns of the partially completed consolidated workpaper.

Required:

Complete the consolidated workpaper for P and S for the year 2017.

P Corporation and Subsidiary

Consolidated Statements Workpaper  December 31, 2017

December 31, 2017

Definitions:

Profit Made

The financial gain achieved when the amount earned from a business activity exceeds the expenses, costs, and taxes.

Board Of Directors

A group of individuals elected by shareholders to oversee the management and make key decisions for a corporation.

Derivative-Action Provision

A component in corporate governance that allows a shareholder to sue or take legal action on behalf of the corporation, often against directors or management for misconduct.

Corporate Opportunity

A business opportunity or prospect that a corporation's directors, officers, or employees might have a duty to offer to the corporation before pursuing independently.

Q3: Estimating the value of goodwill to be

Q6: On a consolidated balance sheet, subsidiary preferred

Q9: Which statement represents a rational application of

Q13: Pinta Company purchased 40% of Snuggie Corporation

Q18: Petunia Company acquired an 80% interest in

Q20: P Corporation acquired 80% of S Corporation

Q21: A segment is considered to be significant

Q36: Explain why every decision requires some sort

Q62: Which of the following is a positive

Q151: Economists use the scientific method and the