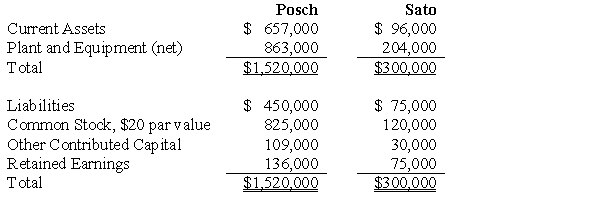

Posch Company issued 12,000 shares of its $20 par value common stock for the net assets of Sato Company in a business combination under which Sato Company will be merged into Posch Company. On the date of the combination, Posch Company common stock had a fair value of $30 per share. Balance sheets for Posch Company and Sato Company immediately prior to the combination were as follows:  If the business combination is treated as an acquisition and Sato Company's net assets have a fair value of $343,200, Posch Company's balance sheet immediately after the combination will include goodwill of:

If the business combination is treated as an acquisition and Sato Company's net assets have a fair value of $343,200, Posch Company's balance sheet immediately after the combination will include goodwill of:

Definitions:

Uncollectible Receivables

Debts owed to a company that are considered to be uncollectable and are written off as a loss.

Debit Balance

Occurs when the total of debits in an account exceeds the total of credits, which can be typical for accounts like expenses, assets, and losses.

Allowance for Doubtful Accounts

A contra-asset account used to estimate the portion of a company's accounts receivable that may not be collectible.

Allowance for Doubtful Accounts

A contra-asset account that represents the estimated portion of accounts receivable that may not be collectible.

Q5: Pallet Corporation owns 90% of the outstanding

Q9: The noncontrolling interest in consolidated income when

Q10: On January 1 2016, Pounder Company purchased

Q14: On January 1, 2016, Pell Company and

Q27: A transaction gain or loss is reported

Q28: The constructive gain or loss to the

Q45: Which statement best describes the absolute advantage

Q54: For what kind of society does a

Q56: Entrepreneurs are willing to take risks because<br>A)

Q150: Many car insurance companies offer discounts for