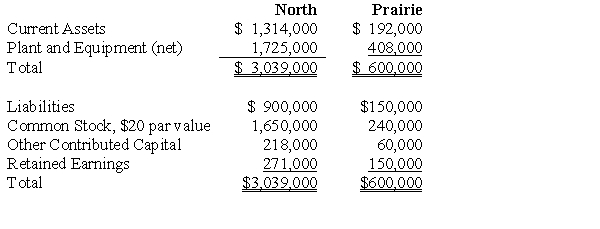

North Company issued 24,000 shares of its $20 par value common stock for the net assets of Prairie Company in business combination under which Prairie Company will be merged into North Company. On the date of the combination, North Company common stock had a fair value of $30 per share. Balance sheets for North Company and Prairie Company immediately prior to the combination were as follows:  If the business combination is treated as an acquisition and the fair value of Prairie Company's current assets is $270,000, its plant and equipment is $726,000, and its liabilities are $168,000, North Company's financial statements immediately after the combination will include:

If the business combination is treated as an acquisition and the fair value of Prairie Company's current assets is $270,000, its plant and equipment is $726,000, and its liabilities are $168,000, North Company's financial statements immediately after the combination will include:

Definitions:

Indirect

In a manner or by means not directly explicit; involving an intermediary or secondary channel.

Direct

The process or manner of communication or transaction that happens without any intermediaries.

Channel Conflict

A situation where channels in a distribution chain are in competition with each other or interfere, leading to reduced efficiency or sales.

Vertical

An industry or market in which businesses provide products or services specific to a particular niche, focusing on a tightly defined area of operation.

Q1: If school teachers are offered more pay

Q3: The opportunity cost of going to school

Q15: Pulman Company acquired 90% of the stock

Q23: A transaction gain or loss on a

Q31: A good is_ if it takes even

Q40: Although generous disability insurance can help those

Q60: What is Chandler's opportunity cost of baking

Q93: To determine which of two producers has

Q114: A dangerous habit among those who own

Q160: _avoids the double coincidence of wants.<br>A) Bartering<br>B)