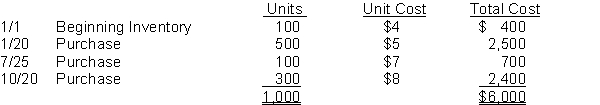

Grother Company uses the periodic inventory method and had the following inventory information available:  A physical count of inventory on December 31 revealed that there were 350 units on hand.

A physical count of inventory on December 31 revealed that there were 350 units on hand.

Instructions

Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is $__________.

2. Assume that the company uses the average cost method. The value of the ending inventory on December 31 is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is $__________.

4. Determine the difference in the amount of income that the company would have reported if it had used the FIFO method instead of the LIFO method. Would income have been greater or less?

Definitions:

Periodic Method

An accounting system where inventory values and cost of goods sold are determined at the end of an accounting period.

Cost of Goods Sold

Costs directly linked to the manufacturing of products sold by a business, encompassing the expenses of materials and labor specifically employed in the product's production.

Gross Profit

The difference between sales revenue and the cost of goods sold before deducting overheads, payroll, taxation, and interest payments.

Periodic Inventory System

An inventory accounting system where stock levels are updated at regular intervals, not continuously.

Q29: An employee authorized to sign checks should

Q145: A new sales representative, Eddy Wherli, has

Q164: Which of the following would not be

Q208: Under a periodic inventory system, the merchandise

Q226: The allowance method of accounting for bad

Q253: The expense recognition principle requires that efforts

Q257: Only large companies need to be concerned

Q258: Which inventory method generally results in costs

Q259: An employee assigned to counting computer monitors

Q282: Payments of expenses that will benefit more