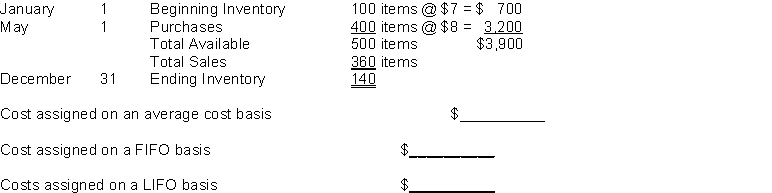

Compute the cost to be assigned to ending inventory for each of the methods indicated given the following information about purchases and sales during the year.

Definitions:

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life.

Noncash Item

Transactions or items that appear on an income statement or in financial statements but do not affect cash flow, such as depreciation and amortization.

Financing Activities

Transactions related to raising capital and repaying investors, included within the cash flow statement.

Creditors

Individuals or institutions that lend money or extend credit, and to whom an entity owes money.

Q47: At Emerson Company, one bookkeeper prepares the

Q70: Which of these would cause the inventory

Q82: To record estimated uncollectible accounts using the

Q111: An asset was purchased for ¥200,000. It

Q124: Wong Ho Company had the following transactions

Q135: The cash balance per books for Wellmeyer

Q167: A petty cash fund should be replenished<br>A)

Q186: Manufacturers usually classify inventory into all the

Q200: Inventory accounting under IFRS differs from GAAP

Q207: A debit memorandum issued by the bank