Use the following information for the next 4 questions.

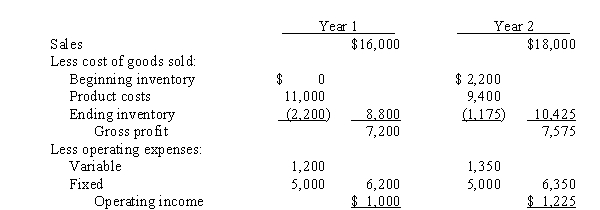

Bella, Inc. has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were:

-Cost of goods sold for year 1 using variable costing would be

Definitions:

Treasury Stock

Securities initially distributed and subsequently bought back by the issuer, which lowers the quantity of shares actively traded on the market.

Common Stock

Equity securities that represent ownership in a corporation, giving shareholders voting rights and a residual claim on corporate earnings in the form of dividends.

Authorized

Pertains to the maximum number of shares a corporation is legally permitted to issue, as specified in its charter.

Stated Value

An assigned value to no-par value stock by the company for accounting purposes, often used to meet state regulations.

Q3: When the Six Sigma process is used

Q6: The triple bottom line refers to which

Q14: If an advanced practice nurse focuses on

Q17: The total standard cost for a unit

Q28: JIT systems are incompatible with absorption costing

Q36: Balanced scorecards, when properly implemented, can guide

Q50: Steps in the post-sales service cycle of

Q83: Budgets can be used to evaluate managerial

Q95: If a supplying division has excess capacity,

Q98: The variable overhead spending variance was<br>A) $10,000