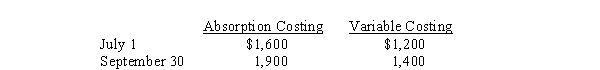

Variable costing income for the period July 1 through September 30 was $400. Inventory data are as follows:  What is the income if absorption costing is used?

What is the income if absorption costing is used?

Definitions:

Installment Method

A tax method allowing income recognition from sales or transfers of property over time as the seller receives payments.

Deferred Payments

Payments or income that are delayed to a future date, which can have various tax implications depending on the nature of the deferral and the tax rules applicable.

Adjusted Basis

The original value of an asset adjusted for factors such as depreciation or improvements.

Like-kind Exchange

A tax deferment strategy allowing for the exchange of similar types of property without the immediate tax liability.

Q3: According to the Neuman health-care system model,

Q5: The first step in implementing a balanced

Q8: The direct labor efficiency variance was<br>A) $2,000

Q11: The balanced scorecard approach to performance evaluation

Q27: The master budget includes two components: an

Q41: When production exceeds sales and costs from

Q60: Which of the following statements about performance

Q84: Unattainable standards are likely to lead to

Q88: Residual income is<br>A) The same as return

Q90: Which of the following is a possible