Use the following information for the next 4 questions.

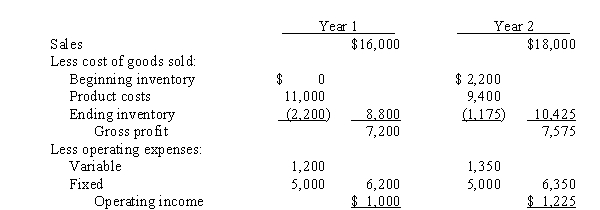

Bella, Inc. has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were:

-Cost of goods sold for year 1 using variable costing would be

Definitions:

Percentage-Of-Completion

An accounting method used to recognize revenue and expenses of long-term projects proportionally based on the project's level of completion.

Construction In Progress

The cost of construction work that has started but not yet been completed or billed to the client.

Partial Billings

Requests for payment for a portion of a project or work completed, often used in long-term contracts or with milestone-based payments.

Direct Cost

Expenses that can be directly attributed to the production of specific goods or services, like raw materials and labor.

Q1: When which type of violence occurs among

Q7: Firms that report GRI core indicators are

Q9: Which organization now serves as the gold

Q11: The tone, pitch, volume, and diction used

Q13: Which of the following refers to the

Q24: The budget variance for variable overhead was<br>A)

Q44: The direct materials inventory increased during the

Q75: Product design, product production, and customer service

Q98: The variable overhead spending variance was<br>A) $10,000

Q106: The budgeted fixed overhead was<br>A) $25,000<br>B) $24,000<br>C)