Use the following information for the next 7 questions.

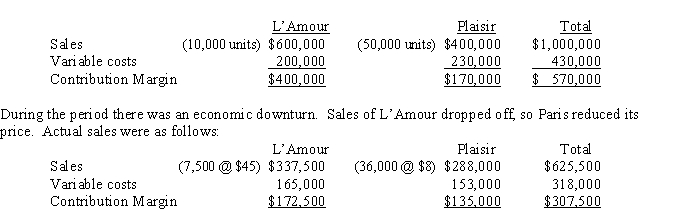

Paris Perfumery sells two perfumes, L'Amor and Plaisir. The expected sales mix is one bottle of L'Amour to five bottles of Plaisir. Planned sales and variable costs for last period were as follows:

-(Appendix 11A) The contribution margin sales volume variance was

Definitions:

Federal Withholding Tax

Taxes automatically deducted from an employee's paycheck by the employer and paid to the federal government.

FICA Taxes

Federal Insurance Contributions Act taxes, which fund Social Security and Medicare, required to be paid by both employees and employers.

FICA Tax

Federal Insurance Contributions Act tax, a U.S. payroll tax that funds Social Security and Medicare, split between employers and employees.

Withholding Allowances

Portions of an employee's pay that are not included in taxable income, used to reduce the amount of tax withheld from their paycheck.

Q3: (Appendix 12A) The nominal method of NPV

Q26: The fixed overhead production volume variance was<br>A)

Q35: Fixed overhead costs are not expected to

Q38: In a traditional manufacturing accounting system, the

Q46: Which of the following steps is not

Q91: The direct labor price variance was<br>A) $2,000

Q98: (CMA) If Ithica Manufacturing decides not to

Q109: Main products have a<br>A) Net realizable value

Q121: Joint costs should be included in the

Q126: TNR's budgeted gross margin is<br>A) $3,600<br>B) $15,600<br>C)