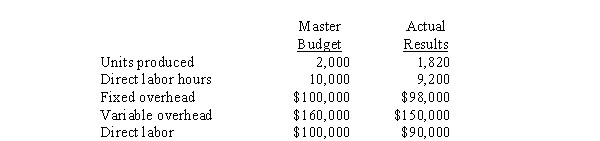

Use the following information for the next 6 questions.

Hyteck, Inc. is a capital intensive firm. Indirect costs make up nearly 70% of the product costs. The company has no direct material costs because customers provide the direct materials used for each job. To plan and control such costs, the firm employs flexible budgets and standard costs. Overhead rates, based on direct labor hours, are derived from the master budget.

-The fixed overhead production volume variance was

Definitions:

Sleep Apnea

A sleeping disorder identified by stops in breathing or shallow breathing phases during sleep.

Life-threatening Condition

A critical state that poses an immediate risk to life, requiring prompt and often intensive medical intervention.

Insomnia

A sleep disorder characterized by difficulties initiating or maintaining sleep, despite adequate opportunity to sleep, leading to impaired daytime functioning.

Helpful Hints

Tips or pieces of advice that are intended to make a task easier or to solve a problem more effectively.

Q4: "Perceived fairness" is sometimes used as a

Q4: A company with a new product decides

Q14: A capital investment's expected useful life is

Q15: When managers use dual-rate allocation, they separate

Q23: In cost-based pricing, managers must use only

Q33: The entry to record the usage of

Q67: Suppose a project's profitability index is 1.12.

Q106: If the direct method is used, maintenance

Q131: Variable costing income for the period July

Q141: Which inventory costing method treats variable overhead