Use the following information for the next 6 questions.

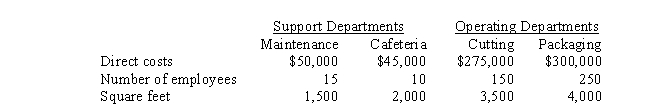

The accountant for Milton, Inc. is preparing the budgets for operating department support service costs. Maintenance costs are allocated based on square feet, and cafeteria costs are allocated based on number of employees. The following data have been collected:

-If the direct method is used, maintenance costs allocated to the cutting department will be

Definitions:

Maximizing Profits

The process of increasing the difference between revenue and costs to achieve the highest possible financial gain.

Economic Profit

The surplus remaining after total costs are subtracted from total revenue, considering both explicit and implicit costs.

Zero Profit

A situation where a firm's total revenues are exactly equal to its total costs, leading to no net gain or loss.

Breaking Even

The situation in which a firm is earning exactly a normal rate of return.

Q26: The fixed overhead production volume variance was<br>A)

Q45: Conversion costs refer to the cost of

Q49: How much of the material handling cost

Q54: Direct materials are added at the beginning

Q55: In January, Wilson Company purchased a new

Q89: Which departments in an organization produce services

Q118: Using the weighted average method, the number

Q123: The variable overhead efficiency variance was<br>A) $8,000

Q126: ELM Corporation introduced a new automated production

Q126: Conversion costs<br>A) Are not used in process