Use the following information for the next 2 questions.

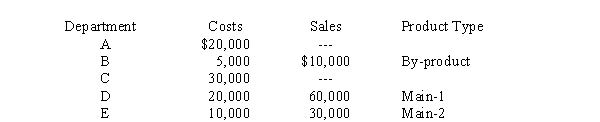

Jagger, Inc. production begins in Department A with 1,000 pounds of material, of which 40% goes to Department B, 50% to Department C, and the rest evaporates. From Department C, 72% goes to Department D, 24% to Department E, and the remainder is scrapped. There are no intermediate markets. By-product sales are treated as miscellaneous income. The following occurred during the month:

-If Jagger uses the physical output method, the total cost of Main-1 is

Definitions:

Overstated Costs

A situation where the reported cost of goods sold or expenses are higher than the actual costs incurred, potentially leading to a lower reported profit.

Product Margins

The difference between the selling price of a product and the cost of goods sold, often expressed as a percentage of sales.

Departmental Overhead Rates

Specific overhead rates assigned to different departments within a company, reflecting the unique costs incurred by each department.

Direct Labour-hours

Direct labour-hours refer to the amount of time spent by workers directly involved in the production process, used to allocate labour costs to units of output.

Q11: The joint costs for the year ended

Q28: The fixed overhead production volume variance was<br>A)

Q33: Which method of allocating joint costs is

Q65: Which items in the table have unfavorable

Q80: Rewarding employees in one production department for

Q95: Which capital budgeting method computes the discount

Q108: Using the weighted average method, the total

Q121: Joint costs should be included in the

Q144: Sales of $250,000 are forecast for the

Q145: The revenues budget<br>A) Estimates overhead costs<br>B) Matches