During the audit of Keats Island Brewery for the fiscal year ended June 30, 2022, the auditors identified the following issues:

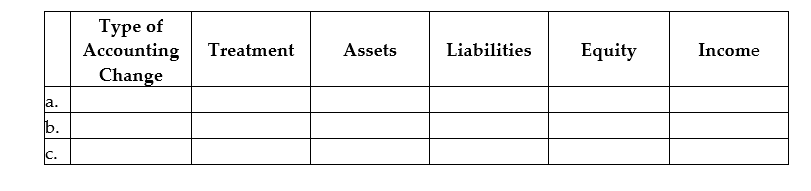

For each of the three issues described below, using the following table, identify both the direction (increase or decrease)and the amount of the effect relative to the amount without the accounting change.

a. The company sells beer for $1 each plus $0.10 deposit on each bottle. The deposit collected is payable to the provincial recycling agency. During 2021, the company had recorded $12,000 of deposits as revenue. The auditors believe this amount should have been recorded as a liability.

b. The company had been using the first-in, first-out cost flow assumption for its inventories. In fiscal 2022, management decided to switch to the weighted-average method. This change reduced inventory by $25,000 at June 30, 2021, and $40,000 at June 30, 2022.

c. The company has equipment costing $6,000,000 that it has been depreciating over 10 years on a straight-line basis. The depreciation for fiscal 2021 was $600,000 and accumulated depreciation on June 30, 2021, was $1,200,000. During 2022, management revises the estimate of useful life to 12 years, reducing the amount of depreciation to $480,000 per year.

Definitions:

Carl Rogers

An influential American psychologist who founded the humanistic approach to psychology, emphasizing the importance of free will, self-actualization, and empathy in therapy.

Humanist Therapist

A mental health professional who applies principles of humanism, focusing on the individual's potential and stressing the importance of growth and self-actualization.

Carl Rogers

A pioneering psychologist who founded the humanistic approach to psychology, emphasizing the importance of self-actualization and the therapist-client relationship.

Unconditional Positive Regard

An attitude of total acceptance and support towards another person, regardless of what they say or do, often considered essential in client-centered therapy.

Q1: Accrual accounting is not relevant under international

Q14: What are actuarial losses or gains in

Q21: A company had taxable income of $2

Q43: What is the implicit rate?<br>A)The interest rate

Q64: An owner investment of office furniture into

Q76: What is "firm commitment" underwriting?<br>A)Broker's guarantee of

Q81: For each of the following events, indicate

Q83: Which statement is correct about basic EPS?<br>A)It

Q84: Liabilities are reported on the:<br>A)statement of owner's

Q127: Lynnwood Services prepaid six months of insurance