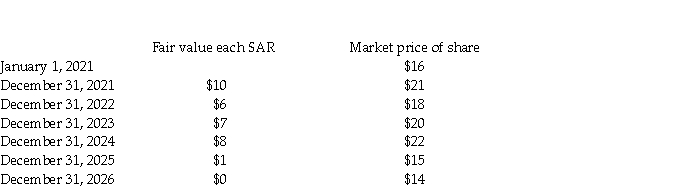

On January 1, 2021 Taffy Inc. granted 210,000 stock appreciation rights (SARs)to its executives. Each SAR entitled its holder to receive cash equal to the difference between the market price of the common share and the benchmark price of $16. The SARs vested after three years and expired on Dec. 31, 2023. On January 1, 2024, 100,000 SARs are exercised. The market price of the shares remained at $20. On January 1, 2025, 50,000 SARS are exercised. The market price of the shares remained at $22. The remaining SARs expired.

Pertinent stock-related data are listed below:  Required:

Required:

a. Prepare the journal entry at December 31, 2021, to record compensation expense.

b. Prepare the journal entry at December 31, 2022, to record compensation expense.

c. Prepare the journal entry at December 31, 2023, to record compensation expense.

d. Prepare the journal entry at January 1, 2024, to record the partial exercise of the SARs.

e. Prepare the journal entry at December 31, 2024, to record compensation expense.

f. Prepare the journal entry at January 1, 2025, to record the partial exercise of the SARs.

g. Prepare the journal entry at December 31, 2025, to record compensation expense.

h. Prepare the journal entry at December 31, 2026, to record compensation expense.

Definitions:

Revenue

The income that a government, company, or organization receives from its activities, often used to refer to business income from sales.

Colonial Colleges

Colonial colleges are nine institutions of higher education in the United States that were established during the colonial period. They include Harvard, William & Mary, Yale, and others, and they played a significant role in the development of American higher education.

Religious Education

The teaching of a particular religion and its beliefs, practices, and moral values, often within an educational setting.

Lending Libraries

Public or private institutions that allow individuals to borrow books and other materials for a set period, promoting education and literacy.

Q7: It is early in February 2020 and

Q15: The rationale behind the enactment of the

Q17: List five features that distinguish managed services

Q17: Select transactions of SimBis Accounting Inc. (SAI)are

Q36: A company issues convertible bonds with face

Q40: Consider the following independent situations. The underlined

Q45: Which statement is correct about the derecognition

Q55: Which is an example of a liability?<br>A)The

Q81: What are the three broad categories of

Q99: Both IFRS and ASPE:<br>A)provide the detailed accounting