SCENARIO 14-3

is a measure of the probability that can

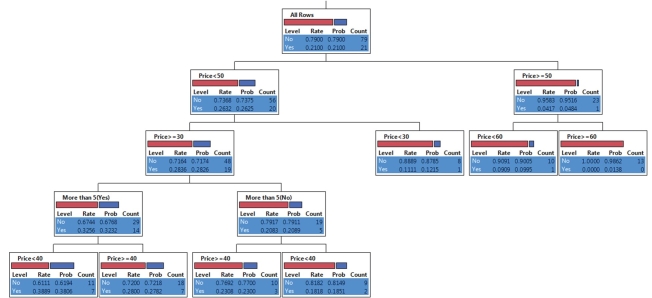

The tree diagram below shows the results of the classification tree model that has been constructed to predict the probability of a cable company's customers who will switch ("Yes" or "No") into its bundled program offering based on the price ($30, $40, $50, $60) and whether the customer spends more than 5 hours a day watching TV ("Yes" or "No") using the data set of 100 customers collected from a survey.

-Referring to SCENARIO 14-3, the first split occurs at what price?

Definitions:

Asset Allocation Funds

Mutual funds that invest in a variety of asset classes, such as stocks, bonds, and real estate, to diversify investment risk.

Event-driven Funds

Investment funds that seek to exploit pricing inefficiencies that may occur before or after a particular corporate event.

Market-neutral Hedge Funds

Market-neutral hedge funds aim to achieve returns with minimal exposure to overall market risk by employing strategies that attempt to offset potential losses in the markets.

Volatile Returns

Refers to the significant ups and downs in the value of an investment over a short period.

Q1: Referring to Scenario 12-5, the correlation coefficient

Q2: Staff on a mental health unit routinely

Q7: A patient is brought to the health

Q17: The nurse is visiting the home of

Q19: Referring to Scenario 12-13, the error sum

Q32: Referring to SCENARIO 14-7, the "complete" method

Q152: Referring to SCENARIO 13-13, the predicted demand

Q167: The prescriptive analytics technique in which the

Q260: Referring to SCENARIO 13-10, to test the

Q304: Referring to SCENARIO 13-18, what should be