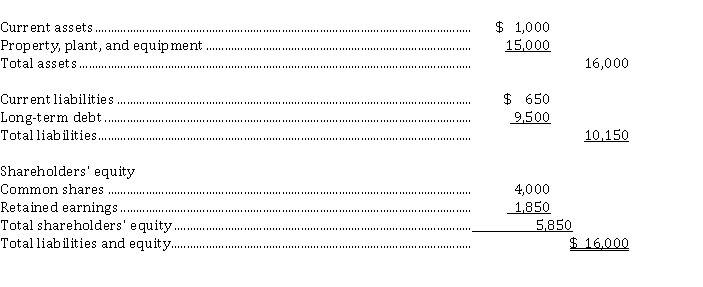

The following is a summarized balance sheet of Falcon Corporation at December 31, 2021. All amounts are in $ 000's.  Falcon requires additional financing of $ 5,000,000 to finance an expansion of its business. The two choices are:

Falcon requires additional financing of $ 5,000,000 to finance an expansion of its business. The two choices are:

Alternative 1: Issue a 20-year, $ 5,000,000 5% bond payable at face value.

Alternative 2: Issue 250,000 common shares at $ 20 each.

In Falcon's industry, a safe debt to total assets ratio is considered to be between 50% and 60%. Falcon's board of directors is risk adverse. Assume that the financing is made at the beginning of the year.

Instructions

a) Calculate the debt to total assets ratio under the two proposed financing methods.

b) Make a recommendation to Falcon on the better financing alternative and explain your choice.

Definitions:

Sea Captain

The person in command of a ship, responsible for its safe navigation and the welfare of its crew.

Titanium-Clad

A material or object covered in titanium to enhance durability and strength.

Mixed-Media Experience

An artistic or entertainment presentation that combines multiple forms of media, such as sound, text, and visuals.

Salt Lake City Library

A public library located in Salt Lake City, Utah, known for its vast collection and modern architectural design.

Q4: Chanti Limited issued $ 200,000, 6%, 10-year

Q72: Dividend revenue is reported under revenues from

Q79: Rice Export Corp. had an increase in

Q81: The main users of financial reporting are

Q126: Claims on economic resources are defined as

Q128: When a bond investment that is held

Q131: Peter and Paul have a partnership agreement

Q154: In a partnership, mutual agency means<br>A) each

Q175: Companies reporting under IFRS will report all

Q190: On January 1, 2021, Bull Corporation purchased