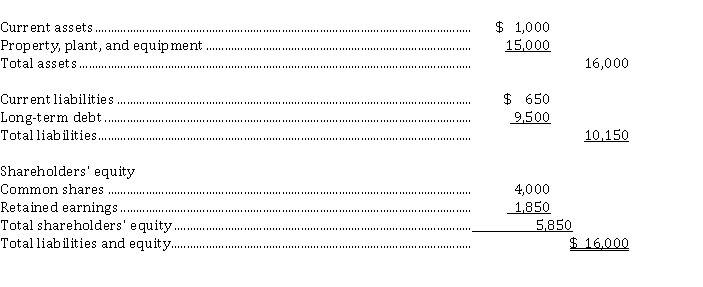

The following is a summarized balance sheet of Falcon Corporation at December 31, 2021. All amounts are in $ 000's.  Falcon requires additional financing of $ 5,000,000 to finance an expansion of its business. The two choices are:

Falcon requires additional financing of $ 5,000,000 to finance an expansion of its business. The two choices are:

Alternative 1: Issue a 20-year, $ 5,000,000 5% bond payable at face value.

Alternative 2: Issue 250,000 common shares at $ 20 each.

In Falcon's industry, a safe debt to total assets ratio is considered to be between 50% and 60%. Falcon's board of directors is risk adverse. Assume that the financing is made at the beginning of the year.

Instructions

a) Calculate the debt to total assets ratio under the two proposed financing methods.

b) Make a recommendation to Falcon on the better financing alternative and explain your choice.

Definitions:

Basic Domains of Language

Fundamental aspects of linguistic communication including phonology, morphology, syntax, semantics, and pragmatics.

Cognitive Approaches

Psychological frameworks that emphasize the importance of mental processes in understanding behavior, including learning, memory, problem solving, and decision making.

Language Acquisition

The process by which humans gain the ability to perceive, produce, and use words to understand and communicate.

Language Acquisition Device

The Language Acquisition Device (LAD) is a hypothetical module of the human mind posited by Noam Chomsky that is proposed to account for children's innate predisposition for language acquisition.

Q17: A change in total partners' capital may

Q17: Convertible preferred shares give common shareholders the

Q18: Jashanpreet Industries Limited (JIL) issued $ 1,800,000,

Q31: A partnership may be based on a

Q34: Max Baer and Jimmy Choo are two

Q39: The admission of a new partner may

Q41: The following information was taken from the

Q112: Companies can only be incorporated under the

Q218: A treasury bill will be shown at

Q242: If a corporation issued bonds at an