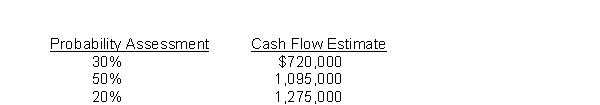

Reegan Company owns a trade name that was purchased in an acquisition of Hamilton Company.The trade name has a book value of $5,250,000, but according to GAAP, it is assessed for impairment on an annual basis.To perform this impairment test, Reegan must estimate the fair value of the trade name.It has developed the following cash flow estimates related to the trade name based on internal information.Each cash flow estimate reflects Reegan's estimate of annual cash flows over the next 7 years.The trade name is assumed to have no residual value after the 7 years.(Assume the cash flows occur at the end of each year.)  Reegan determines that the appropriate discount rate for this estimation is 6%.To the nearest dollar, what is the estimated fair value of the trade name?

Reegan determines that the appropriate discount rate for this estimation is 6%.To the nearest dollar, what is the estimated fair value of the trade name?

Definitions:

Guanxi

A Chinese term that describes the establishment of networks or connections that facilitate business and other dealings.

Kibbutzim

Collective communities in Israel that operate on principles of shared ownership, responsibility, and living, traditionally based on agriculture.

Economic Difficulties

Challenges related to financial stability and growth in an economy.

Satisfactory Schooling

The provision of education that meets the expected standards and requirements for learning and development.

Q8: Most purchase commitments must be recorded as

Q30: In a statement of cash flows, proceeds

Q51: Under IFRS, how is the account revaluation

Q62: If an annuity due and an ordinary

Q67: On whose books should the cost of

Q73: Compound interest uses the accumulated balance at

Q76: A trial balance may prove that debits

Q91: Land held for speculation is reported in

Q108: On the statement of financial position, an

Q108: If the compounding period is less than