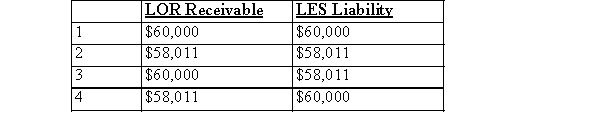

On January 1, 2014, LOR leased a machine (original cost $60,000) to LES for a 5-year period at an implicit interest rate of 15 percent.The lease qualified as a direct financing lease and the annual lease payments ($17,306) are made each December 31.LOR retained the $4,000 estimated unguaranteed residual value , LOR's net receivable and LES's liability would be (round to the nearest dollar) :

Definitions:

Arrested

The act of detaining a person by legal authority on suspicion of their involvement in a criminal activity.

Child Maltreatment

Abuse or neglect of a child by a parent, guardian, or other caretaker, resulting in potential harm or injury.

Physical Abuse

Involves the infliction of bodily harm upon another person through forceful means, often in contexts of power imbalance.

Sexual Abuse

Any form of non-consensual sexual contact or behavior, often involving coercion and trauma to the victim.

Q37: Kate Corporation sold a truck resulting in

Q47: A change in accounting principle occurs when

Q89: When convertible bonds are submitted for conversion,

Q130: RST's net income for the year ended

Q145: If the five million dollar investment in

Q151: Depreciation expense for the most recent fiscal

Q152: A bargain purchase option in a finance

Q154: Operating leases are usually of shorter duration

Q178: A lease which contains a bargain purchase

Q180: ML leased a computer to LH on