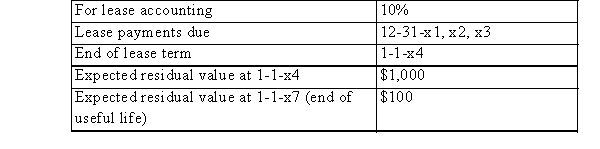

The following information relates to a lease contract: Lease inception = 1-1-x1

Market value and book value (to lessor)of New equipment under lease = $10,000 Interest rate used by both lessee and lessor  The lease allows the lessee to purchase the asset for $200 on 1-1-x4.

The lease allows the lessee to purchase the asset for $200 on 1-1-x4.

There are no uncertainties with respect to collectability of lease payments, or performance by lessor.

(a)Determine the annual lease payment

(b)Classify the lease for the lessee

(c)Record the 2014 entries

Definitions:

Federal Level

Relating to or denoting the central government as distinguished from the separate units constituting a federation.

Transfer Program

A government initiative designed to redistribute income through the transfer of money from one group to another.

Temporary Assistance

Short-term aid or support provided by governments or organizations to individuals or families in need.

Needy Families

Households lacking sufficient income or resources to maintain an adequate standard of living, often targeted by social assistance programs.

Q4: Anti-dilutive convertible securities would generally be used

Q5: Wholly-owned subsidiaries are required to disclose earnings

Q19: The following information is available to you:

Q39: Under a sales-type lease, the lessor recognizes

Q61: On January 1st, 2014, ABC Inc.(the lessor)agrees

Q100: Options are ONLY for the purpose of

Q104: JMR Corporation has one asset worth $350,000.Depreciation

Q111: Fractional share rights are usually issued:<br>A)At the

Q118: You calculate basic EPS to be $15.87

Q131: Under ASPE, forfeitures which occur under a