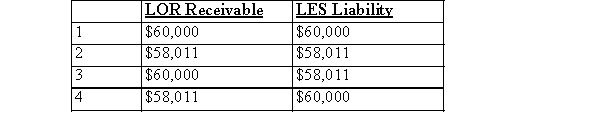

On January 1, 2014, LOR leased a machine (original cost $60,000) to LES for a 5-year period at an implicit interest rate of 15 percent.The lease qualified as a direct financing lease and the annual lease payments ($17,306) are made each December 31.LOR retained the $4,000 estimated unguaranteed residual value , LOR's net receivable and LES's liability would be (round to the nearest dollar) :

Definitions:

Internal Codes

Policies, rules, or guidelines adopted within an organization or institution to govern its operations and conduct.

Administrative Agency

A government body empowered to implement particular legislation, manage public policy, and regulate certain activities within its jurisdiction.

Department of Homeland Security

A cabinet department of the U.S. government charged with protecting the United States from terrorist attacks and responding to natural disasters.

Cabinet-Level Department

A major administrative unit in the executive branch of the government, typically headed by a Secretary, that deals with broad areas of national policy.

Q4: The recovery of income tax expense is

Q10: Listed below are a number of errors.Indicate

Q34: At December 31, 2013, XYZ had 40,000

Q46: On January 1, 2014, a lessor and

Q72: Current service costs are the main component

Q79: On January 1, 20x1, DB purchased equipment

Q80: An asset that cost $49,500 was being

Q84: XYZ decided to change its depreciation policy

Q100: Why is the gross method used by

Q215: Amanda Company leased an office building for