LAC has negotiated a lease agreement with LEC effective January 1, 2014.LAC will provide LEC with a special-purpose building for ten (10)years.The lease is non-cancellable; requires LEC to provide maintenance, insurance, taxes, etc.; and stipulates that the building reverts back to LAC's control at the end of the lease.The building cost LAC $200,000 and is expected to have no residual value at the end of the lease.LAC expects a 15% return on investments and the lease qualifies as a direct financing lease.Rents are paid each December 31 starting in 2014.

(a)How much annual rent will the lessee pay (rounded to the nearest dollar)? $ _.

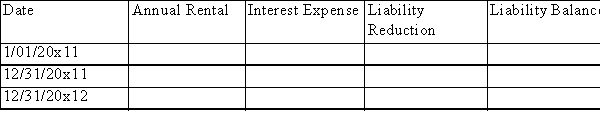

(b)Complete the following schedule of lease amortization for the lessee for the first two years:  (c)Complete the following entries for the lessee: January 1, 2014, inception of lease.

(c)Complete the following entries for the lessee: January 1, 2014, inception of lease.

December 31, 2014, first rental payment and lessee's year-end entries (end of the accounting period).December 31, 2014, accrual by lessee of $4,000 taxes on the building and payment of $800 for repairs on the building.

Definitions:

Forward Contract

A financial derivative that represents a customized agreement to buy or sell an asset at an agreed-upon price on a specific future date.

Spot Rate

This is the current market price at which a particular currency can be bought or sold for immediate delivery.

Cash Flow Hedge

A financial strategy used to manage the risk of fluctuating cash flows due to changes in exchange rates, interest rates, or commodity prices.

Net Method

An accounting system that records transactions with their net effect, considering any discounts or allowances for prompt payment.

Q31: If a company issues debt that is

Q71: Better matching is achieved when deferred income

Q78: On January 1, 2014, ABC Incorporated issued

Q93: Disclosure related to tax loss carry forwards

Q99: KG Company had capital assets with a

Q105: The effective interest method is normally used

Q125: The increases in account balances of XYZ

Q126: Which of the following statements concerning stock

Q155: A lessee capitalized a lease with a

Q203: LMN made the following journal entry relating