Lessor Company leases small computers on three-year leases at the end of which the residual value

is not material in amount.Rents are collected at year-end.On January 1, 2014, Lessor signed a 3-year lease with Lessee Company that called for annual rents of $12,063, which was a return to

Lessor of 10% on the $30,000 cost (market value at date of lease).Assume the lease qualifies as a direct financing lease to the lessor and a finance lease to the lessee.There was no bargain purchase option or residual value.The lessee's incremental borrowing rate is 12%.

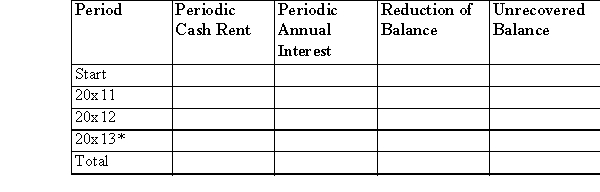

(a)Complete the following amortization schedule for the lease.Round to the nearest dollar.  * May have slight rounding error.

* May have slight rounding error.

(b)Can both the lessor and lessee use the amortization schedule values in this instance? Yes ________ No ________

Explain why _.

(c)Give the entries for the lessor and lessee on the following dates (assume the accounting period ends December 31).Use the abbreviated account titles.

January 1, 2014-Inception of the lease:

December 31, 2014-Interest date and end of accounting period (give all entries except closing entries):

December 31, 2014-Interest date and end of accounting period (give all entries except closing entries):

Definitions:

Target Audience

A specific group of consumers identified as the intended recipients of an advertising or marketing message, based on shared characteristics.

Advertising Program

An advertising program is a comprehensive plan that outlines the marketing and communication strategies, including media channels and creative concepts, used to achieve advertising objectives.

Fear Appeal

A marketing strategy that uses the element of fear to motivate the audience to take a certain action or adopt a specific behavior.

Tune Out

The act of ignoring or choosing not to engage with a message, advertisement, or piece of content.

Q15: If the corporation purchases common treasury stock,

Q15: Explain what is meant by off-balance sheet

Q32: At the end of 2014, interest on

Q33: Current costs of a pension plan that

Q38: Last year, TUV had 40,000 $15 par,

Q50: Steps in calculating diluted EPS include the

Q103: Lamont Company leases computers for a three-year

Q131: Under ASPE, forfeitures which occur under a

Q149: On January 10, 2013, ZOE Corporation declared

Q175: On December 31, 2015, JKL leased a