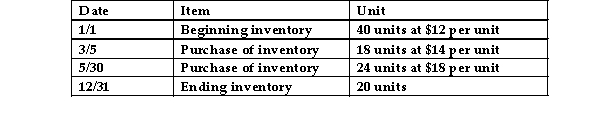

Given the following data, calculate the gross profit using the average- cost method, if the selling price was $20 per unit.

Definitions:

Tax Rate

The percentage at which an individual or corporation is taxed.

Depreciate Equipment

The process of allocating the cost of a tangible asset over its useful life, reflecting the decrease in the asset's value over time.

NOPAT

Net Operating Profit After Tax; a measure of company profitability that excludes the cost and benefits of financing and investments.

Net Cash Flows

The difference between a company's cash inflows and outflows over a specific period, showing the company's financial health and liquidity.

Q2: At December 31, 2015, ABC Company has

Q22: All business transactions involve an increase in

Q29: Normal business risks that are insured must

Q34: The purpose of owning trading securities is

Q34: The Accumulated Depreciation account represents a Contra-

Q55: Paid- in capital is the amount of

Q73: Depreciation allocates the cost of a plant

Q77: The ending inventory using the LIFO costing

Q82: A primary reason a company "goes public"

Q106: Notes receivable that are paid in installments