Steven James earned $150,000 this year in profits from his proprietorship, which placed him in a 45 bracket. The rate of tax for Canadian-controlled private corporations in his province is 15% on the fi

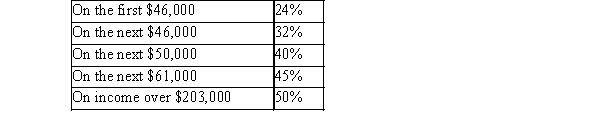

$500,000 of income. Personal tax rates (federal plus provincial)in James' province are:  (All rates are assumed for this question.)

(All rates are assumed for this question.)

Steven withdraws $3,000 per month for his personal living expenses. All remaining profits are used t taxes and to expand the business. Steven expects the same business after-tax profits next year.

Steven is considering incorporating his business next year. If he incorporates, he will pay himself a g salary of $48,000.

Required:

A. Determine the increase in Steven's cash flow if he incorporates his company? Show all calculation

B. Name the type of tax planning that Steve would be engaging in if he incorporated his company.

Definitions:

Q2: Longhorn Fabricators Inc. plans to expand its

Q2: Which of the following cases is not

Q3: On March 1, 20x1, Notes Inc. purchased

Q5: An individual has the option to receive

Q6: What is the focus of health promotion

Q7: Which of the following statements is TRUE

Q8: The Running Shoe Corp. is a Canadian

Q9: The sum of "outsider claims" plus "insider

Q24: Drugs, Inc. recently received approval from the

Q30: The exchange rate for the Euro was