Steven James earned $150,000 this year in profits from his proprietorship, which placed him in a 45 bracket. The rate of tax for Canadian-controlled private corporations in his province is 15% on the fi

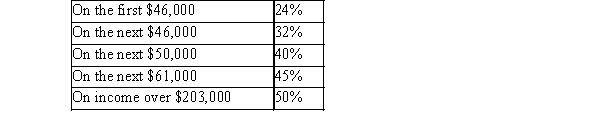

$500,000 of income. Personal tax rates (federal plus provincial)in James' province are:  (All rates are assumed for this question.)

(All rates are assumed for this question.)

Steven withdraws $3,000 per month for his personal living expenses. All remaining profits are used t taxes and to expand the business. Steven expects the same business after-tax profits next year.

Steven is considering incorporating his business next year. If he incorporates, he will pay himself a g salary of $48,000.

Required:

A. Determine the increase in Steven's cash flow if he incorporates his company? Show all calculation

B. Name the type of tax planning that Steve would be engaging in if he incorporated his company.

Definitions:

Reference Documentation

Documents containing necessary information on standards, operations, or specifications for reference purposes.

Motor Control Circuits

Circuits specifically designed to control the performance and operation of electric motors.

Wiring Diagrams

Wiring diagrams are schematic representations of electrical circuits, showing the connections and layout of an electrical system or circuit.

Mechanical Overload

A condition where a machine or its components are subjected to forces beyond their design capacity, potentially causing failure.

Q1: A Chinese official is considering construction of

Q1: What are examples of complementary and alternative

Q2: Determine the real rate of return of

Q5: Stick Co. owns land with a fair

Q8: The acronym GAAP stands for:<br>A)Generally Acceptable Authorized

Q21: A private metropolitan mass transit system

Q21: Stockholders' equity decreases as a result of:<br>A)owner

Q23: According to the CDC, one of the

Q27: A manufacturer of hardboard and fiber cement

Q46: A consolidated balance sheet shows:<br>A)combined assets and