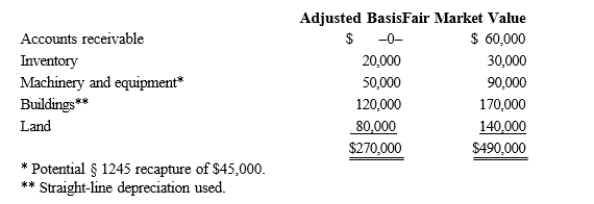

Albert's sole proprietorship owns the following assets.  Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Blaming the Victim

A phenomenon where the victim of a crime or any wrongful act is held entirely or partially responsible for the harm that befell them.

Attitude

A psychological construct representing an individual's degree of like or dislike for an item.

Belief

An acceptance that something exists or is true, especially one without proof.

Fundamental Attribution Error

A cognitive bias that causes people to overemphasize personal characteristics and ignore situational factors in judging others' behavior.

Q11: Black, Inc., is a domestic corporation with

Q16: Molly transfers land with an adjusted basis

Q34: Last year, Darby contributed land basis of

Q43: Which of the following statements correctly reflects

Q64: Sylvia spends time working at the offices

Q65: How can double taxation be avoided or

Q68: A distribution from the other adjustment account

Q69: Tax-exempt income at the S corporation level

Q88: What method is used to allocate S

Q145: Potential depreciation recapture<br>A)Cash basis accounts receivable, for