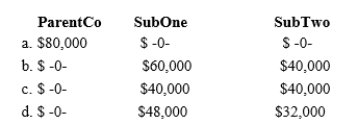

ParentCo, SubOne, and SubTwo have filed consolidated returns since year 2. All of the entities were incorporated in Taxable income computations for the members include the following. None of the group members incurred any capita transactions during these years, nor did they make any charitable contributions. How should the Year 3 consolidated net operating loss be apportioned among the group members?

Definitions:

Tertiary Sector

The segment of the economy that provides services rather than goods, including sectors like retail, education, healthcare, and financial services.

Economy

A system of production, distribution, and consumption of goods and services within a society or geographical area.

Addictions Counsellor

A professional who specializes in providing guidance and treatment for individuals dealing with substance abuse and behavioral addictions.

At-Risk Youth

Refers to young people who are exposed to the risk of poor outcomes due to socio-economic, behavioral, or family-related factors.

Q1: In working with the foreign tax credit,

Q2: ParentCo and SubCo report the following items

Q30: Nondeductible meal expense must be subtracted from

Q50: When a corporation has cancellation-of-debt relief in

Q55: Gabriella and Maria form Luster Corporation with

Q58: A realized gain from an involuntary conversion

Q84: Silver Corporation, a calendar year taxpayer,

Q86: Rex and Scott operate a law practice

Q95: Member's capital gain.<br>A)Increases stock basis of subsidiary<br>B)Decreases

Q120: A new affiliate uses the LIFO method