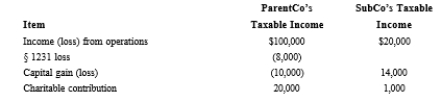

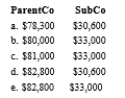

ParentCo and SubCo recorded the following items of income and deduction for the current tax year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

Definitions:

Emotional Stability

A personality trait characterized by consistency in emotions, lack of excessive emotional reactions, and the ability to remain calm under pressure.

Psychotherapy

Psychotherapy is a therapeutic treatment primarily involving verbal communication used to help individuals overcome mental health problems or emotional difficulties.

Conceptual Knowledge

Understanding that is based on conceptualizing the relationships between ideas, principles, and abstract concepts, rather than relying solely on memorization of facts.

Staff Professional

A term that may not denote a specific concept but implies a professional member of an organization's staff, proficient and skilled in their field of expertise.

Q12: William is a general partner in the

Q20: Finch Corporation distributes property basis of $225,000,

Q23: ForCo, a foreign corporation, receives interest income

Q56: ParentCo and SubCo report the following items

Q97: Distribution of $100,000 cash representing the partner's

Q98: Pebble Corporation, an accrual basis taxpayer, has

Q100: Which of the following is a specific

Q110: In computing consolidated taxable income, the profit/loss

Q126: Hendricks Corporation, a domestic corporation, owns 40

Q135: The rules for computing Federal consolidated taxable