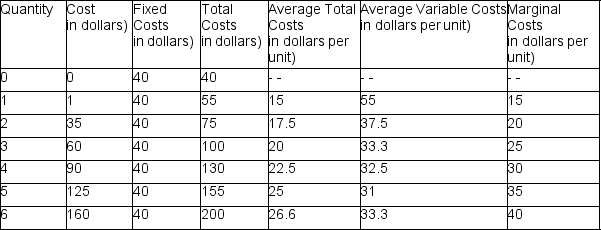

Refer to the table below.

If the firm sells 5 units at a price of $30 each, then the marginal unit produced

Definitions:

LIFO of $450,000

The last-in, first-out method applied to inventory that results in an ending balance of $450,000.

LIFO Reserve

The difference between the cost of inventory calculated using the Last In, First Out (LIFO) method and the cost calculated using the First In, First Out (FIFO) method.

FIFO Assumption

An accounting method where the first items purchased or produced are the first ones used or sold.

LIFO Reserve

The difference in value between inventory calculated using the Last-In, First-Out (LIFO) method and the First-In, First-Out (FIFO) method, used to adjust COGS and inventory valuation.

Q9: If, over a three-year period, sales increased

Q12: _ include all of the costs of

Q14: In 2010, Americans had about _ outstanding

Q15: In the circular flow diagram model:<br>A) households

Q15: The model that economists use for illustrating

Q21: Briefly discuss how a higher rate or

Q23: A decrease in consumer preference for a

Q28: Which of the following lies primarily within

Q30: Define consumer surplus, producer surplus, and social

Q50: The figure below shows the demand curve