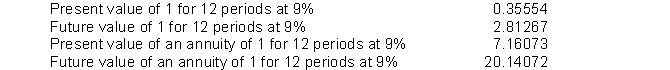

Montz Company is considering investing in an annuity contract that will return $80,000 annually at the end of each year for 12 years. Montz has obtained the following values related to the time value of money to help in its planning process and compounded interest decisions.  To the closest dollar, what amount should Montz Company pay for this investment if it earns a 9% return?

To the closest dollar, what amount should Montz Company pay for this investment if it earns a 9% return?

Definitions:

Q9: avid Jones deposited $6,500 in an account

Q20: The basic accounting entries for merchandising are<br>A)

Q35: All of the following are terms used

Q45: Stock splits do not impact the value

Q53: Turner Corporation returned $150 of goods originally

Q99: An auditor is an accounting professional who

Q177: Fehr Company sells merchandise on account for

Q187: Listed below in alphabetical order are the

Q189: If the single amount of $12,500 is

Q257: For a jewelry retailer, which is an