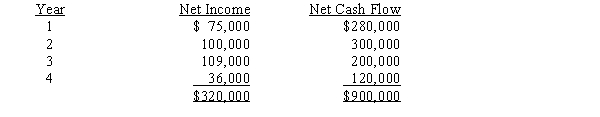

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:  The company's minimum desired rate of return is 12%. The factors for the present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years are 0.893, 0.797, 0.712, and 0.636, respectively.Determine the net present value.

The company's minimum desired rate of return is 12%. The factors for the present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years are 0.893, 0.797, 0.712, and 0.636, respectively.Determine the net present value.

Definitions:

Regulatory Environment

Comprises laws, regulations, and governmental guidelines that govern the operation of businesses and industries.

Political Environment

Refers to the impact of government actions, stability, policies, and regulations on an organization's operations.

Equilibrium Price

The price at which the number of products that businesses are willing to supply equals the amount of products that consumers are willing to buy at a specific point in time.

Q11: Target selling price to be achieved in

Q25: Finch, Inc., has purchased a new server

Q31: Used to assess performance in achieving the

Q56: Possible result of using an inappropriate overhead

Q57: Focuses on research and development initiatives and

Q79: Alexander and Kristin are executive managers at

Q106: Nighthawk Inc. is considering disposing of an

Q127: A company is contemplating investing in a

Q135: The direct labor rate variance is<br>A)$5,490 unfavorable<br>B)$5,490

Q150: Since the variable factory overhead controllable variance