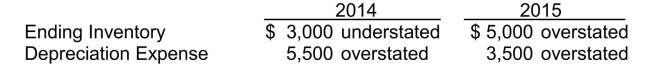

Use the following information for questions through.Ignore taxes. Peach Inc.'s financial statements for the years 2014 and 2015 contained errors as follows:

-Assuming that NONE of the errors were detected or corrected, and that no additional errors were made in 2016, by what amount will current assets at December 31, 2015 be overstated or understated?

Definitions:

Income Tax Rate

The proportion of income that is subject to taxation for a person or a company.

Consolidated Income Tax Return

A single income tax return filed for a group of related corporations, consolidating their tax liabilities.

Ownership

The state or fact of legal possession and control over property, which includes the rights to use, sell, or lease it.

Deferred Income Tax Asset

A tax asset that reflects a company's ability to reduce future tax liability due to deductible temporary differences.

Q11: A brass wire (d = 2.0

Q14: Macaroon Corp.has sold goods at terms 1/10,

Q15: How should cumulative preferred dividends in arrears

Q53: A hollow aluminum shaft (G =

Q67: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7504/.jpg" alt="

Q83: Assuming a corporation has no contributed surplus

Q218: In jurisdictions where par value shares are

Q264: Under IFRS, equity does NOT include<br>A)long term

Q266: White Resources determines that it has not

Q382: Adjusting entries are NOT used to<br>A)obtain a