As a marketing manager for a large sports apparel manufacturer, you are trying to decide whether to open a

new factory outlet store, which would cost about $500,000. Success of the outlet store depends on demand in the

new region. If demand is high, you expect to gain $1 million per year; if average, $500,000; and if low, to lose

$80,000. From your knowledge of the region and your product, you feel the chances are 0.4 that sales will be

average, and equally likely that they will be high or low (0.3, respectively). Assume that the firm's MARR is

known to be 15%, and the marginal tax rate will be 40%. Also, assume that the salvage value of the store at the

end of 15 years will be about $100,000. The store will be depreciated under a 39-year property class.

(a) If the outlet store will be in business for 15 years, should you open the new outlet store? How much would

you be willing to pay to know the true state of nature?

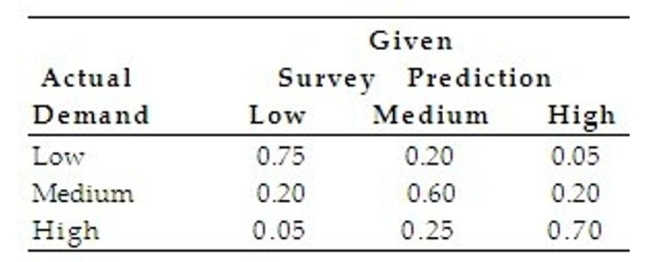

(b) Suppose a market survey is available at $1,000 with the following reliability (values obtained from past

experience where actual demand was compared with predictions made by the market survey).  Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute

Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute

the EVPI after taking the survey. What is the true worth of the sample information? Assume that you are a

risk-neutral person so that you are interested in maximizing the expected monetary value.

Definitions:

Rate Of Change

The speed at which a variable quantity, such as a number or measurement, changes over a certain period of time.

Sheet Steel

A type of steel that has been rolled into sheets; commonly used in manufacturing and construction industries.

Risk Profile

A plot showing how the value of the firm is affected by changes in prices or rates.

Interest Rate Volatility

The extent to which interest rates fluctuate over time due to market forces, economic policies, or external events.

Q5: A $40,000 investment in working capital is

Q6: Margin of error: four percentage points; confidence

Q14: <span class="ql-formula" data-value="\frac { ( x -

Q25: Identify the null and alternative hypotheses.

Q27: If one of the individuals is randomly

Q31: Test the given claim using the traditional

Q100: <span class="ql-formula" data-value="\begin{array}{c|c|c|c}\begin{array}{c}\text { Original } \\\text

Q126: Suppose a city with population of 170,000

Q237: <span class="ql-formula" data-value="f = \{ ( 6

Q286: The formula <span class="ql-formula" data-value="\mathrm