SCENARIO 17-2 One of the most common questions of prospective house buyers pertains to the cost of heating in dollars (Y) . To provide its customers with information on that matter, a large real estate firm used the following 4 variables to predict heating costs: the daily minimum outside temperature in degrees of Fahrenheit (X1) , the amount of insulation in inches (X2) , the number of windows in the house (X3) , and the age of the furnace in years (X4) . Given below are the EXCEL outputs of two regression models.

Model 1

Regression Statistics R Square Adjusted R Square Observations 0.80800.756820 ANOVA

Regression Residual Total df41519 SS 169503.424140262.3259209765.75MS42375.862684.155F15.7874 Significance F0.0000

Intereept X1 (Temperature) X2 (Insulation) X3 (Windows) X4 (Furnace Age) Coefficients 421.4277−4.5098−14.90290.21516.3780 Standard Error 77.86140.81295.05084.86754.1026 t Stat 5.4125−5.5476−2.95050.04421.5546 P-value 0.00000.00000.00990.96530.1408 Lower 90.0% 284.9327−5.9349−23.7573−8.3181−0.8140 Upper 90.0% 557.9227−3.0847−6.04858.748413.5702

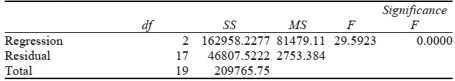

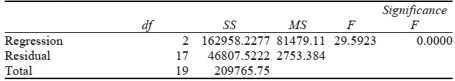

Model 2

Regression Statistics R Square Adjusted R Square Observations 0.77680.750620

ANOVA

Intercept X1 (Temperature) X2 (Insulation) Coefficients 489.3227−5.1103−14.7195 Standard Error 43.98260.69514.8864t Stat 11.1253−7.3515−3.0123 P-value 0.00000.00000.0078 Lower 95% 396.5273−6.5769−25.0290 Upper 95% 582.1180−3.6437−4.4099

-Referring to Scenario 17-2, the estimated value of the partial regression parameter β1 in Model 1 means that

Common Dividends

Payments made by a corporation to its common shareholders from its after-tax profits.

Professional Judgement

Professional Judgement involves applying expertise, knowledge, and experience to make informed decisions and assessments in the context of accounting and auditing.

Accrual Accounting

An accounting method that records revenues and expenses when they are incurred, regardless of when cash transactions occur, providing a more accurate picture of a company's financial health.

Diversification

A risk management strategy that mixes a wide variety of investments within a portfolio or a company's product line to minimize risks.