SCENARIO 17-11

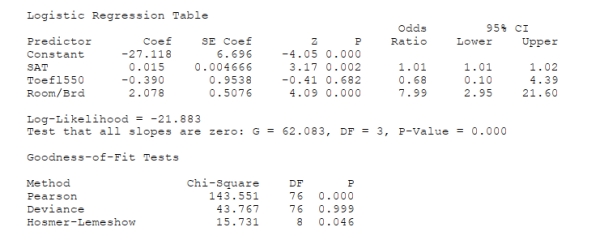

A logistic regression model was estimated in order to predict the probability that a randomly chosen

university or college would be a private university using information on mean total Scholastic

Aptitude Test score (SAT) at the university or college, the room and board expense measured in

thousands of dollars (Room/Brd), and whether the TOEFL criterion is at least 550 (Toefl550 = 1 if

yes, 0 otherwise.) The dependent variable, Y, is school type (Type = 1 if private and 0 otherwise).

The Minitab output is given below:

-Referring to Scenario 17-11, there is not enough evidence to conclude that SAT

score makes a significant contribution to the model in the presence of the other independent

variables at a 0.05 level of significance.

Definitions:

Out-Of-Pocket Expenses

Costs that an individual must pay out of their own cash reserves, including medical expenses, business expenses not reimbursed, and other personal expenditures.

Self-Employed Health Insurance

A deduction that allows self-employed individuals to deduct 100% of their health insurance premiums from their taxable income.

AGI Deduction

Reductions from gross income that lower an individual's taxable income, based on specific expenses and contributions.

Net Earnings

The amount of income left after deducting expenses, taxes, and deductions from gross revenue.

Q45: Referring to Scenario 17-2, what are

Q66: Referring to Scenario 19-5, what is the

Q92: Referring to Scenario 17-1, what are the

Q119: Referring to Scenario 19-6, what is the

Q177: Referring to Scenario 17-1, one individual in

Q191: Referring to Scenario 17-10 Model 1, what

Q193: A physician and president of a Tampa

Q339: Referring to Scenario 17-11, there is not

Q351: Data mining uses various techniques to extract

Q373: Referring to Scenario 17-12, there is not