SCENARIO 16-9

Given below are EXCEL outputs for various estimated autoregressive models for a company's real operating revenues (in billions of dollars) from 1989 to 2012.From the data,you also know that the real operating revenues for 2010,2011,and 2012 are 11.7909,11.7757 and 11.5537,respectively.

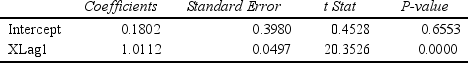

First-Order Autoregressive Model:

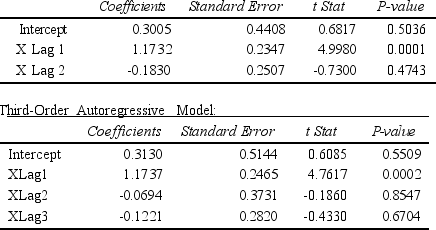

Second-Order Autoregressive Model:

Second-Order Autoregressive Model:

-Referring to Scenario 16-9 and using a 5% level of significance,what is the appropriate autoregressive model for the company's real operating revenue?

Definitions:

Forecast Error

The variance between what actually happens and the forecasts from prediction models.

Expected Value

Expected value is a concept in probability that calculates the average outcome when the future involves scenarios that may or may not happen.

Moving Average Forecast

A method used in time series analysis to smooth out short-term fluctuations and highlight longer-term trends or cycles.

Observable Trend

A pattern, change, or movement in data or events that can be detected and analyzed through observation.

Q11: Referring to Scenario 16-4, exponential smoothing with

Q55: A trend is a persistent pattern in

Q83: Referring to Scenario 15-6, what is the

Q151: Referring to Scenario 16-14, to obtain

Q162: Referring to Scenario 16-15-B, you can reject

Q176: Referring to Scenario 17-8, you can

Q223: Referring to Scenario 16-11, using the second-order

Q281: Referring to Scenario 17-12, the null hypothesis

Q306: Successful use of a regression tree requires

Q374: Referring to Scenario 14-4, which of the